A Seismic Event - The Great Repricing

How Japan and The Global Bond Markets Could Trigger The Next Bitcoin Move

Disclaimer: Any views expressed in the below text are the personal views of the author/s and do not constitute investment advice or recommendations for investments. The author/s views should not form the basis for making investment decisions - invest in markets at your own risk after performing thorough due diligence.

While everyone is focussing on the obvious negative macro headwinds such as high inflation figures, energy supply shocks (Rus-Ukr), the plethora of geopolitical tensions, interest rate rises and a tightening monetary regime in the US alongside extremely precarious global risk and equity markets – there is an event potentially brewing which not many are discussing at present.

The event specifically revolves around the economy of Japan. We could be seeing a seismic asset repricing if exogenous threats and pressures worldwide put more stress on an already stretched financial system and weakened national currency. We examine the bullish case for Bitcoin if this scenario comes to fruition. Enjoy.

Summary

In 2016, the Bank of Japan (BOJ) adopted yield curve control (YCC), fixing interest rates at -10 bps and the 10-year bond yield at 0% for as long as necessary to achieve an inflation target of 2% for economic growth.

Economies will continue to face inflation risks and subsequent rate hikes for the foreseeable, therefore bond yields outside of Japan will continue to rise.

If YCC remains in place, this will cause the Yen to depreciate further in purchasing power against other currencies such as the USD, EUR, and GBP.

If the BOJ removes YCC due to a plethora of external pressures and a depreciating Yen, there will be huge ramifications for risk assets.

There will potentially be trillions of dollars worth of capital flying around repricing assets whilst looking for a new home and higher yield.

Whether this is good or bad for risk assets is yet to be determined, however, we wager that the falling value of the global bond markets will eventually lead to a tipping point where more QE (and subsequent M2) is needed in support.

The Bond Markets

A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). Any bonds issued have an end/maturity date when the principal of the loan is due to be paid to the bond owner and usually include the terms for variable or fixed interest payments made by the borrower.

Bond prices are generally inversely correlated with interest rates, hence the recent bloodbath in bond markets as interest rates have risen, therefore also leading to bond yields rising.

Governments commonly use bonds to raise funding for various infrastructure projects such as roads and schools, whilst corporations will often borrow to grow their business, buy equipment and hire employees. The main issue for larger organizations is that they typically need far more money than the average bank can provide. Bonds provide a solution by allowing many individual investors to assume the role of the bank as a lender.

Figure 1 - Advantages and disadvantages of bond issuance to both the lender and borrower. Source - Investopedia

There are two primary categories of bonds traded and sold in the markets:

Corporate bonds - Issued by companies to raise finance instead of seeking bank loans due to bonds offering lower interest rates and more flexible terms. These are widely regarded as moderate/low risk.

Government bonds - For example, those issued by the US Treasury are regarded as low risk. Maturities of <1 year are called “bills”, 1-10 years are called “notes” and >10 years are called “Bonds”. The entire category of bonds issued by a government treasury is often referred to as treasuries. Government bonds issued by national governments may be referred to as sovereign debt.

Bond markets are more intelligent than equity markets by nature, simply due to the calibre and sophistication of the investors involved. It is commonly overlooked by retail but should be carefully monitored for signs of wider market direction and sentiment.

Our favourite bonds to monitor are the US2Y, US10Y, US30Y, JP2Y and JP10Y.

The Samurai - Seppuku 切腹

Japan has the third-largest economy after the US and China, it has the world's second-largest foreign exchange reserves, worth $1.4T, and globally is third in nominal GDP output as shown in Figure 2 below:

Figure 2 - Nominal GDP output by country in Trillions ($). Source - IMF

Interestingly, Japan has the largest net international investment position in the world. Much of this goes into fixed income assets such as Japanese government bonds (JGBs), as Japan has a cash hoarding, deflationist economy owing to the ageing and declining population demographics combined with a traditionally risk-averse nature.

The Japanese economy faces considerable challenges due to its declining population, which peaked at 128M in 2010 and has fallen to 125.5M in 2022. Projections show the population will continue to fall, potentially to below 100M by the middle of the 21st century. Japan’s birth rate may be falling because there are fewer opportunities for young people in the country’s economy. A lack of good jobs is creating a cohort that won’t marry or have children due to affordability.

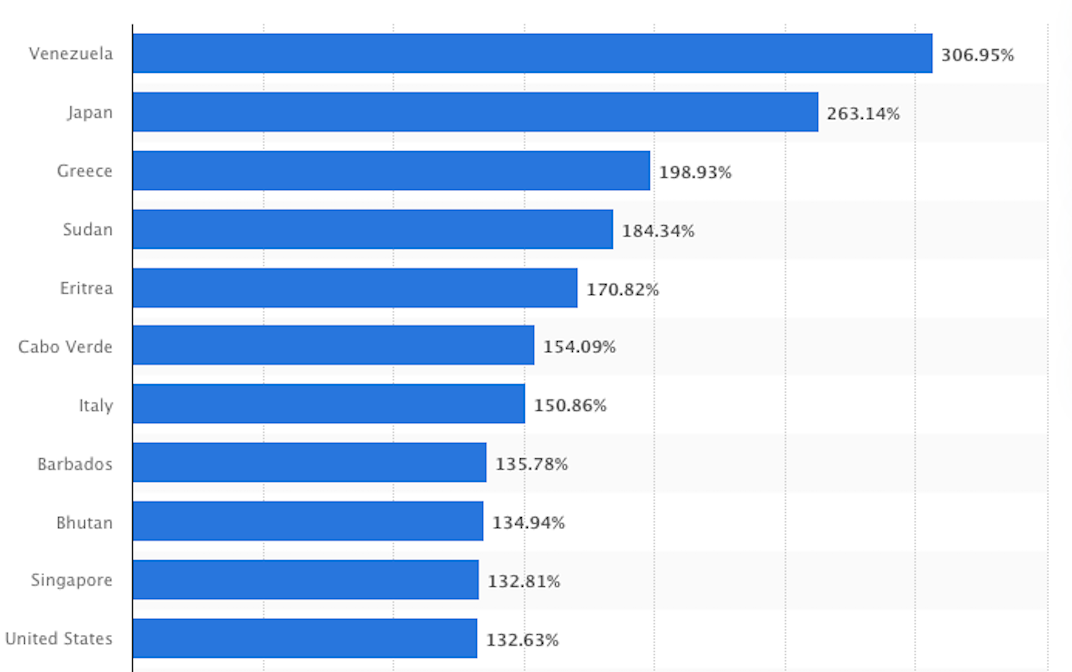

As of 2021, Japan had significantly higher levels of public debt than any other developed nation.

Japan's debt began to swell in the 1990s when its real estate bubble burst in cataclysmic fashion. Various stimulus packages combined with the rapidly ageing population and associated high healthcare and social security costs led to Japan's debt breaching 100% of GDP at the end of the 1990s and hitting 200% in 2010. Their debt is now sitting at around 263% of the total GDP.

Figure 3 - GDP to debt % of countries. Note that even the US has 132% debt to GDP output. Source - Statista

Japan’s long-lasting deflation/low inflation has also posed a severe problem for the economy for decades. Since 1995, the inflation rate in Japan has continuously been around zero or below (currently at 3%), indicating the country’s sustained weak economic performance. The Bank of Japan (BOJ) has attempted to tackle the weak growth in a quest to fulfil its mandate of maintaining price stability and providing a foundation for the nation's economic activity and growth.

Figure 4 - Japanese inflation rate in % terms. Source - Tradingeconomics.com

In January 2013, the BOJ established a price stability target of 2% inflation. Shortly afterwards, in April 2013, a reflationary-minded new Governor Haruhiko Kuroda led the BOJ to initiate Quantitative Easing (QE), which we explained in depth in a previous article. As a result, short-term interest rates were initially targeted at around 0% and ultimately went into negative territory in January 2016 in an attempt to encourage borrowing, spending and investment instead of saving.

Concerns started to emerge about the side effects associated with QE. This mainly stemmed from the Negative Interest Rate Policy (NIRP) of Japan; the risk of destabilization of the financial system through pressure on institutions' profits became problematic. If this risk was to materialize QE would be less effective, and it would become more difficult for the BOJ to achieve price stability and sustainable economic growth within a feedback loop.

After three years of QE, the inflation rate was still below 2%. The initial timeline to achieve the price stability target was around two years after the introduction of QE and, by mid-2016, market participants were fully aware of the delay.

Insidious Machinations - Yield Curve Control

In September 2016, Yield Curve Control (YCC) was introduced to complement QE. It targeted both short/long-term interest rates capping them at -10bps alongside the 10Y bond yield at 0%. The new policy was introduced in hopes of achieving the price stability target of 2%, while also considering the effects on the functioning of financial intermediaries and institutions.

QE deals with the bond quantity (buying them back whilst printing money to do so) - whilst YCC deals primarily with the bond prices.

This led Japanese banks to become more speculative in their search for higher profit opportunities such as international expansion and various loan products. They gradually moved their investment portfolios outward on the risk curve.

In essence, the muted profits that YCC and NIRP gave domestic banks and institutions eventually led to a net flight of capital out of the country to seek better yields elsewhere and has led to a cratering $JPY against most global fx pairings, most notably the $DXY due to its relative strength with interest rate rises.

Figure 5 - Japanese Yen vs. US Dollar. Observe how the $JPY has been in freefall since interest rates began to rise in the US around January 2022.

Figure 6 - Japanese Yen vs. Euro. Observe how the $JPY has been in freefall since the ECB began to raise interest rates around January 2022.

Negative Interest Rates - The Failed Exploit

Globally, there is now more than $12T in government bonds trading at negative rates. This does nothing for an indebted government, and even less to make businesses more productive. Negative interest rates may incentivise banks to withdraw reserve deposits, but they do not create any more borrowers or attractive business investments. Japan's NIRP didn’t make asset markets more rational or efficient.

By May 2016, the BOJ was a top 10 shareholder in 90% of the stocks listed on the Nikkei 225 and owned over 50% of the JGBs in the country.

There is a disconnect between standard macroeconomic theory by which borrowers and investors react fluidly to the real world and monetary policy. History does not reflect kindly on governments and banks that have attempted to print money into generalised prosperity. This is because currency, as a commodity, does not directly generate an increased standard of living. Only an increase in the quality of goods and services provided can achieve this, furthermore, it is clear that an increase in circulating bonds is not the route to increases in living standards for a population.

Game Theory - The Bullish Case for Bitcoin

Japan's net external assets hit 411 trillion yen ($3.24 trillion) in 2021, whilst also being the largest foreign holder of US debt. Japan can sell US treasuries to defend the purchasing power of the Yen at any point, therefore causing huge rallies in US bond yields as we have seen of late. The US Fed is also selling treasuries off its balance sheet with QT whilst other large holders like China have also been selling aggressively.

As yields rise in other nations - Japan will see an increasing outward flight of capital and acceleration of the depreciating Yen, therefore, causing an unintended negative feedback loop when attempting to sell US treasuries to defend the Yen initially.

Japan and Do Kwon have much in common. They are deploying their national treasury to prop up the Yen's value in the fx markets. If they continue YCC while also deploying reserves, they are in essence converting US Treasuries into JGBs. The BOJ should know the endgame for a currency that deploys this strategy from Mr Kwon’s various misadventures.

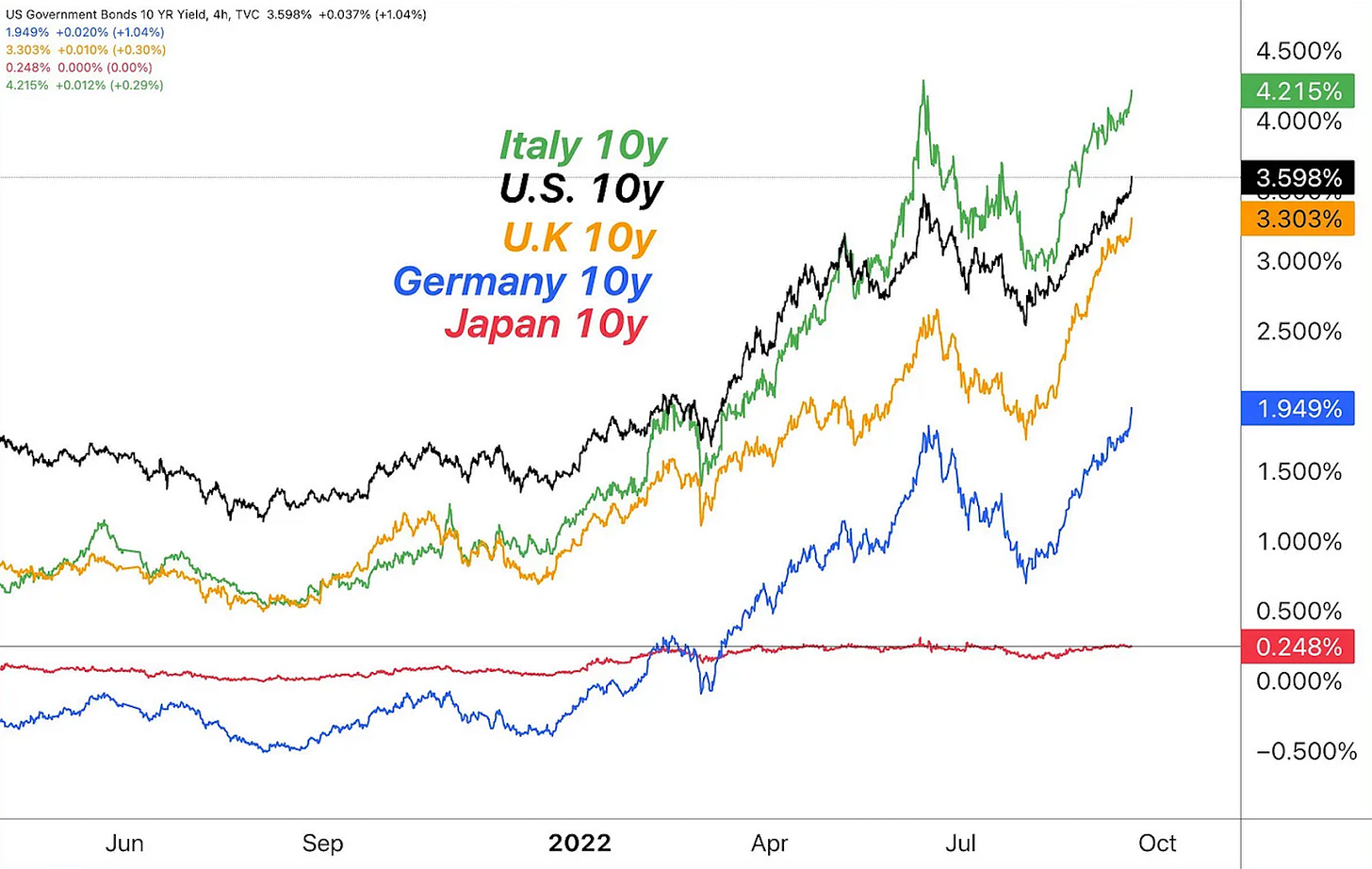

Figure 7 - 10Y JGB yields against other nations’ 10Y yields. JGB yields remain muted whilst other countries are rallying violently whilst losing ‘real’ value. Source - TradingView (Inspired by @DylanLeClair_)

As long as the BOJ is the only major bank with negative rates the Yen will continue to be the release valve.

As previously mentioned, rising bond yields connote the underlying value of the bond decreasing.

Figure 8 - Global bond market losses aggregated with previous drawdowns visualised. 2022 has been a record downward year for value. Source - Bianco Research LLP

Historically, drawdowns in the bond markets of this magnitude were thought of as impossible - nevertheless, a 40-year high in inflation, aggressive rate hikes, and record low/negative interest rates have proven to be a dangerous cocktail for bond investors. Aggregate global bond market losses are around 21% at present. A record year.

We can combine the explanations and data already presented with the below game theory for how things may play out moving forwards. It is written by a good friend of mine @fejau_inc and was posted here on Twitter.

“Putin strongarms Europe by shutting off Energy pipelines, causing a spike in prices. This causes energy prices to skyrocket in Europe which is a major component of CPI - this causes inflation to explode higher.

As CPI explodes higher, electricity prices get passed onto consumers. Eventually, at the risk of civil unrest/revolution over refusal to pay this, EU governments have two options:

Give into Putin and let him have Ukraine and stop the sanctions to get energy flowing again.

Decide to deploy price caps on energy for consumers and print the difference.

To achieve this I believe ECB needs to instill YCC to keep bond yields intact and avoid fragmentation of EU sovereign bonds. The game theory I've ascribed to this makes me think that the West is too far deep into this mess to give into Putin and would rather print the difference. No government ever willingly went broke through austerity. They will always resort to printing.

Printing the difference through YCC is going to cause $DXY to explode higher as 58% of $DXY is the Euro. $DXY to 150 - dollar milkshake theory stuff. This dollar wrecking ball will cause emerging markets (EM’s) to begin potentially defaulting on their debt, forcing them to sell their US bonds to buy US dollars to defend their currencies. As EM's sell US bonds to amass dollars to defend their currencies, US bond yields will explode higher causing systemic risks in US markets as everything is priced off US treasuries. Something will break. The Fed then has two options to fix this - they will likely explore both:

Swap lines with ECB and BOJ (standing swap line facility launched on 1st July 2021). This allows them to easily lend dollars via central bank reserves to these central banks which will help bring down $DXY and stabilize sovereign FX markets.

They can then also use their new standing repo facility (July 2021) to provide overnight loans to stabilize funding/treasury markets on short duration bonds. The usage of this swap line facility and repo facility is net stimulative and will cause the $DXY to fall and markets to stabilize (though I believe everything will be nuking during this time as correlations go to 1 when institutions unload risk to get their VaR's in line).

In conclusion, we're at the end of a major sovereign bond bubble and this energy crisis is the catalyst. The Fed will be forced to stimulate or risk full implosion of the monetary system. What will be unique about this time Oil will still be going higher, not lower.

As the game theory plays out, our goal is to find the optimal moment to long crypto after this coming flush. I see many takes from people who think QE is never coming again but it will, just under other names.”

Fejau_inc and I share many views about this global state of affairs, previous rationale from articles on the substack attest to this.

The one major drawback to the above game theory revolves around the limitations and drawbacks that YCC is clearly presenting for the Japanese economy at present. If the Yen falls through a theoretical ‘pain threshold’ in purchasing power, the BOJ will have to wave the white flag and stop YCC to prevent their national currency from nuking any further. If this scenario ends up playing out (it may well do in the coming months due to the fragility of the Japanese economy as described above), then popular opinion may prevent both the ECB and the US from considering the implementation of YCC.

Another interesting theory again revolving around the global bond markets involves Bitcoin being expressed in global bond performance.

Figure 9 - Bitcoin/global bond index expressed as a ratio. Interestingly this is a good proxy for risk on/off globally in asset allocation. Source - StockCharts.com

Why is it relevant to compare the $130T global bond market with the meagre 0.28T market capitalisation of Bitcoin?

If bond investors re-allocate even a small portion of holdings into Bitcoin to hedge against further bond weakness (as Bitcoin is now seen as a sensible long-term hedge using the efficient frontier), it will immediately cause the above chart in Figure 9 to rally.

In conclusion, the lower bonds go, the more QE is needed to support the markets. More QE will lead to more M2 in circulation and this will cause Bitcoin and the crypto market to rally against its dollar denomination but also eventually in real terms.

No one knows the true ramifications of the BOJ’s YCC potentially failing in the face of a rapidly depreciating Yen. However, we know that there will potentially be trillions of dollars flying around the global financial system looking for a new home outside of Japan and JGBs. This could cause a seismic repricing of liquid assets worldwide.

The real question is whether large Japanese investors move outwards on the risk curve and begin investing small allocations into Bitcoin as a hedge.

We wager that they will.

It's a stretch to assume Japanese investors will want to risk on into BTC. Human nature is to risk off. Only the few can make bets.