Disclaimer: Any views expressed in the below text are the personal views of the author/s and do not constitute investment advice or recommendations for investments. The author/s views should not form the basis for making investment decisions - invest in markets at your own risk after performing thorough due diligence.

The essence of asymmetry within both life and financial markets revolves around the perpetual quest to seek an edge over any and all competition. In this way, our articles are an attempt to provide the information necessary to fully inform you about digital assets alongside traditional finance and various macroeconomic principles. We are attempting to build a fully populated archive of information pertaining to the above.

So far, in our attempt at building this information bank, we have only provided longer-form content. We will also now be providing more regular short-form, digestible content, thereby offering a commentary and overview of topical subjects.

For the first article, we are delving into our thesis on Oil prices in 2022 and introducing some key ideas and discussion points.

Black Gold

Oil is a great leading indicator for risk assets and crypto markets. The asset class perfectly demonstrates global and local economic performance, growth and prosperity through its demand profile which is subsequently reflected in its price movements.

There are many reasons for the link between economic growth and oil prices. However, the most glaringly obvious is simply the fact that global industry is predominantly fueled by oil (or gasoline, if you’re that way inclined).

Conventional wisdom holds that increases in oil prices will raise input costs for businesses, thereby reducing corporate earnings and forcing innovation, adaptation and growth during times of accommodative monetary policy. The inverse is generally true when oil prices fall. These feedback loops are established through the reflexivity of oil prices and deviations from expectations and reality - an investment concept coined by the famous investor George Soros. In this manner, risk assets such as equity markets, tech stocks and cryptocurrencies generally have a very high correlation with the prices of oil in the medium-term.

Figure 1 - WTI Crude price action since 2009. Our theorised price movements for the next year are marked in blue. Source: TradingView

Anomalous Price Action

Since the advent of Covid-19 and the subsequent global lockdowns in March 2020, oil prices have undergone some incredible movements that many thought impossible.

Prices have generally been trending upwards due to:

Accommodative monetary policy and the availability of excess capital in the economic machine through Fed balance sheet expansion and quantitative easing.

The Russian invasion of Ukraine (causing supply shock price increase).

The combination of an oil price war between the Western and Eastern countries and the global pandemic helped briefly send oil prices to -$37 per barrel. This incredibly abnormal occurrence was caused by a technical imbalance in the futures markets. Speculators, who were long oil with no intention to take physical delivery, fuelled a massive sell-off of expiring contracts. Once the arbitrageurs and physical/futures markets eventually re-aligned alongside the initial Covid-19 panic easing, QE-driven inflation caused prices to rally dramatically to where they are now around $90 per barrel.

Figure 2 - The price action of Oil as it crashed below $0 in the futures market during the Covid panic of 2020. Source: Bloomberg

Russia Has Already Won

We have heard many remarks about how badly Russia has miscalculated things in H1 of 2022 – many of these comments stem from the awful human and emotional toll that this unjust war has delivered. However, other than a monumental military blunder (which may have also been planned), Russia has absolutely dominated the West in political and economic chess since the start of the invasion. President Biden and Western leaders have been fools and acted in a knee-jerk manner with their sanctions.

Given the short-term non-fungibility of oil and gas and Russia’s ability to sell it to players who do not respect the Western sanctions, the US and their allies have not only put themselves in a precarious position regarding energy security entering winter 2022, but they have also lost a lot of political clout with the middle east – most notably Saudi Arabia.

All of this has taken place whilst the Russian Ruble has jumped 45% against the dollar since January, with one dollar worth 60.12 Rubles today (08/08/2022).

Figure 3 - The Russian Ruble has risen in value against the US Dollar since the invasion.

Many Western and NATO member states were forced into Russian sanctions due to an inherent fear of being hard-balled by the rest of the coalition. Countries such as Germany were reluctantly pressured into backing the sanctions even though nearly 55% of their natural gas comes from Russia…The German economy minister Robert Habeck mentioned that this energy crisis could trigger a “Lehman-like contagion” whilst this month Hamberg is preparing to ration hot water due to energy insecurity.

It seems the sanctions are not having the desired effect.

Meanwhile, European consumers are paying significantly more at the pump. Russia is now in a much stronger economic condition than they were at the beginning of this war due to sanctions backfiring. We foresee that this will embolden Russia to play hardball with Europe come Autumn when we simply have no viable alternative to Russian gas.

Gas is much more constrained than oil, Russia cannot simply deliver it to China or India as the pipelines and infrastructure aren’t in place as they are in Europe.

Thanks to our sanctions, Russia now has far more oil revenue than it did when the war began, alongside more bargaining power. Putin is making a fool of Biden, whose crippling sanctions aren’t crippling anyone but American and European consumers.

Saudi oil imports from Russia were logged at 647,000 tonnes (April-June) but were 320,000 tonnes in the same period one year ago. The Saudis and Chinese are now buying cheaper oil from Russia to re-sell back to the West at marked-up rates. Beyond this, moving into winter, the worst-case scenario is an OPEC oil production cut to add to all the aforementioned dynamics at play. We wager this is a real possibility given the US’ often strained relationship with many member states such as Iran, Iraq, Kuwait and Libya.

To further investigate the precarious situation and energy supply shock we are now starting to see the effects of, we must tie the above points surrounding Russian sanctions into the wonton dilution and open market selling of the Strategic Petroleum Reserve (SPR).

What is the SPR?

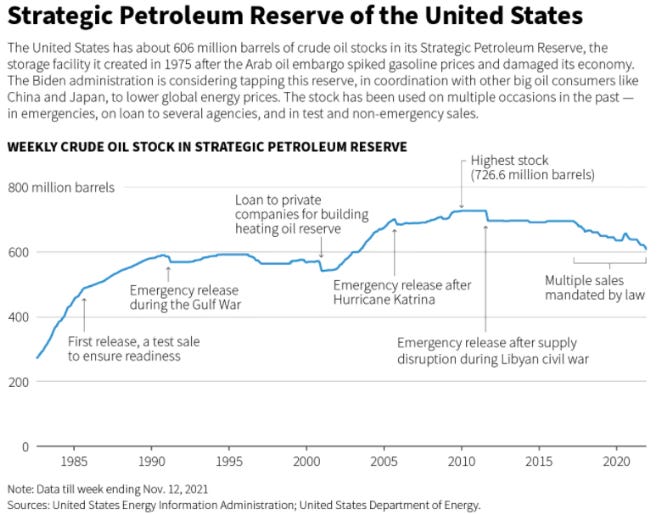

The US created the SPR in 1975 after the Arab oil embargo dramatically spiked prices and caused serious harm and cessation of activity in the US economy - it took nearly 1.5 years to recover.

Figure 4 - Graph to outline the quantity of oil in the SPR and the key contributing events for fluctuations.

US presidents are able to tap into the stockpile to smooth the oil markets during periods of war, adverse black swan events or when hurricanes hit concentrated oil infrastructure such as in the Gulf of Mexico.

The reserve currently holds about 606 million barrels in four heavily guarded locations on the Louisiana and Texas coasts. This is roughly enough oil to meet U.S. demand for more than a month and acts as an insurance policy for the above potential eventualities. The SPR also acts as a barometer for the countries’ immediate military effectiveness and ability to both attack and defend when presented with any exogenous (or endogenous) threats.

The US has over 50% of the world's SPRs, with Japan and China in close second and third, respectively, also with extremely large reserves. Other countries include the UK, Germany, and Australia which all hold 90 days' worth of reserves.

Today the US SPR is sitting around 492 million barrels (lowest since 1985) due to Biden’s continual release and selling into the open market in an attempt to ease prices at the pump in the short term.

This is purely a political points-scoring move and will only last as long as he feels the need to drain the SPR - which in itself is irresponsible to the extent he has thus far.

The US now has around 20 days of reserves left and with the Russian war in Ukraine set to continue for the foreseeable and the extreme oil supply shock of not having Russia (a huge net exporter of oil) as a viable trade partner due to sanctions - there is no way out of the inevitable price increases for the Western consumer.

Whilst oil is traditionally a risk asset associated with economic growth and inflation - its price increases lately are deviating from their correlation with Bitcoin etc. We are targeting WTI crude to be at $140 or higher by EOY or when Biden stops selling the SPR into the open marketplace.

There are a number of senators moving against Biden currently due to the reckless selling. Senators James Lankford (R-OK) and Ted Cruz (R-TX) introduced the 'No Emergency Crude Oil' for Foreign Adversaries Act to guarantee that stocks sold from the Strategic Petroleum Reserve (SPR) are not shipped to antagonistic nations such as China.

Being long Oil is an excellent hedge against any high timeframe downside price action likely occurring soon in the wider economy.

Figure 5 - Our theorised price action for the DOWJ index due to the need to curb inflationary forces and raise rates.

SPR is now at 53% of total capacity (01/08/2022). With China potentially already emboldened in their stance towards Taiwan by the West’s weak response to Russia invading Ukraine alongside the provocative recent visit by Sen. Nancy Pelosi, the US war machine is dramatically weakened in its ability to not only attack but also defend (-47%).

Is this wise? I think we all know the answer, and Biden is playing with fire.

Summary

Oil markets are highly correlated to risk assets and inflationary forces.

Extreme supply shocks due to the Russian-Ukraine war combined with knee-jerk sanctions have put the West in a precarious position moving into the winter.

Sanctions have also weakened the West against Russian allies such as Saudi Arabia, China and India.

Biden’s political point-scoring approach of selling the SPR into the open market to temporarily decrease prices at the pump for US consumers will backfire as soon as he is forced to stop diluting the market.

All of the above will likely lead to a bigger rally into Q4 for oil, higher prices at the pump and a much deeper supply shock for Western countries and NATO.